by Austin Robey

Traditional startup roadmap

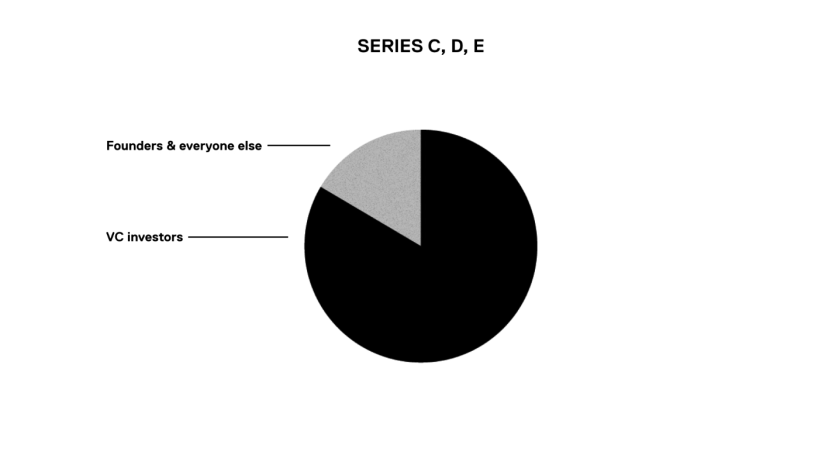

Investor ownership is the default for technology companies and startups. Typically, founders go from owning 100% of a company, to gradually selling more and more in sequential fundraising rounds. Often, investors will purchase 20-30% of a company in each round of funding. After several rounds of funding, investors are likely to own a vast majority of the business, many times over 80%.

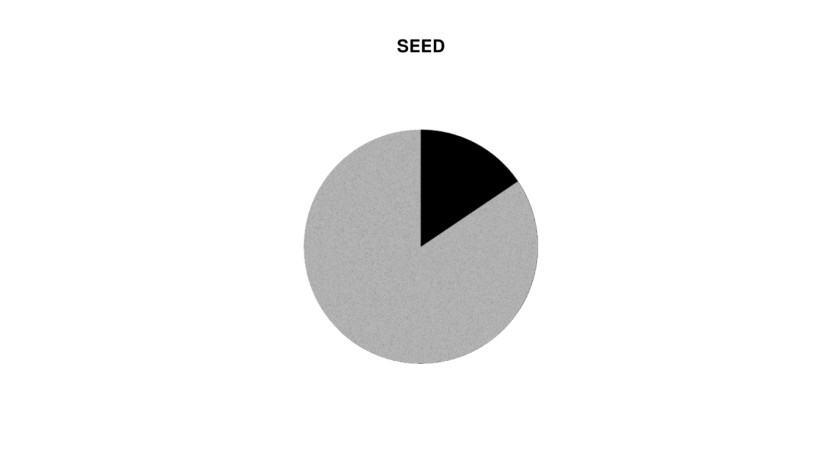

It may look something like this.

Seed:

Company raises a seed round by offering investment notes that convert to 10-15% ownership of the company.

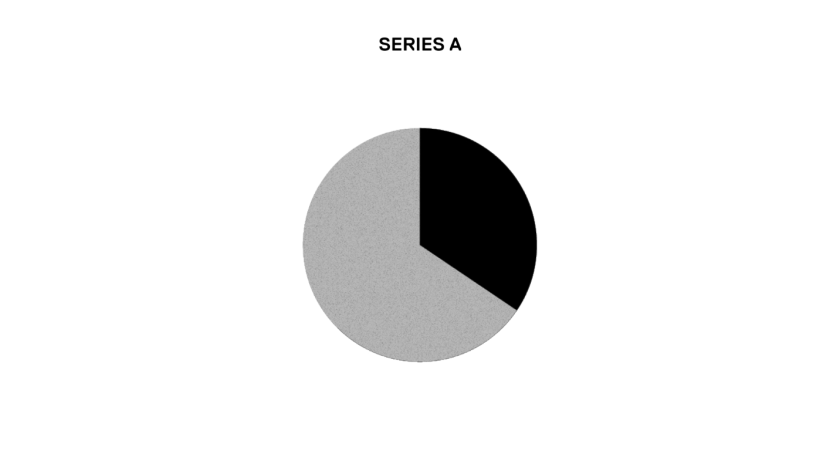

Series A:

Company raises 18 months of runway by selling another 20% of ownership to a collection of VC firms.

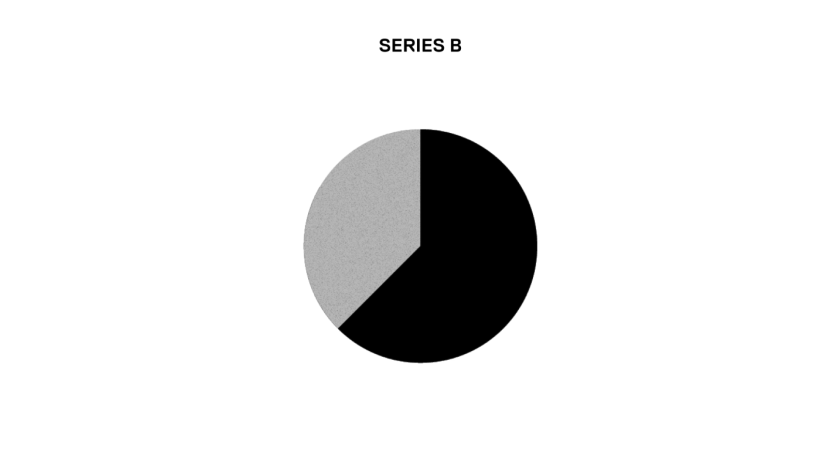

Series B:

Company repeats cycle.

Series C, D, E (and beyond):

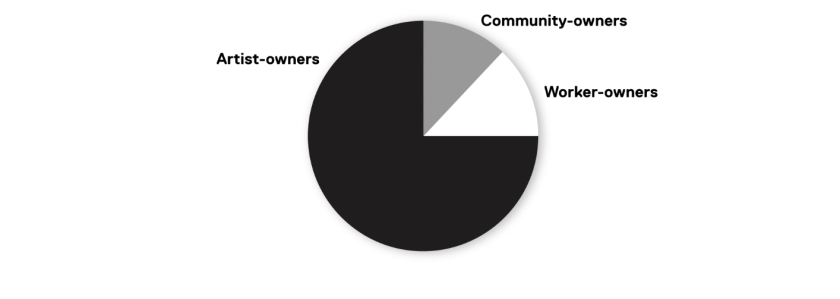

An alternative: User-owned platforms

There is an alternative. It may not be customary in Silicon Valley, but it’s possible to have platforms owned 100% by their users. How?

1. Cooperative ownership:

-

Organization incorporated as a cooperative

-

Fully member-owned

-

Not created for an exit opportunity for investors

-

1 person 1 vote governance, not power weighted by stake

2. Labor organization:

-

Organization and product built by users

-

People contributing towards a shared vision

-

Reliance on production capital, rather than financial capital

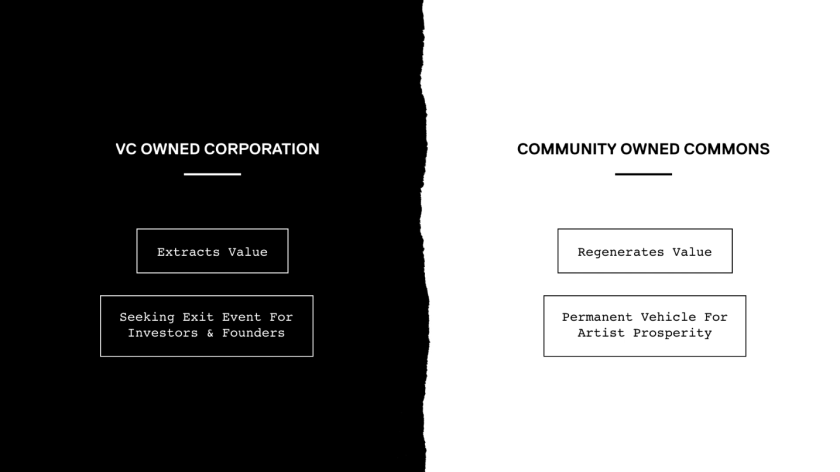

Investor ownership vs. user ownership

Here are what these differences look like:

|

Investor Owned |

User Owned |

|

|

Value |

extracted from users |

captured by users |

|

Economic Rewards |

concentrated to few |

shared by many |

|

Motivation |

financial maximization |

service to members |

|

Revenue Model |

rent-seeking platform fee |

commons contribution |

|

Goal |

exit event (transactional value) |

sustainable independence (use case value) |

|

Decision Making |

autocratic |

democratic |

|

Mindset |

competition |

cooperation |

|

Culture |

individualism |

collectivism |

Would you rather be a user or an owner?