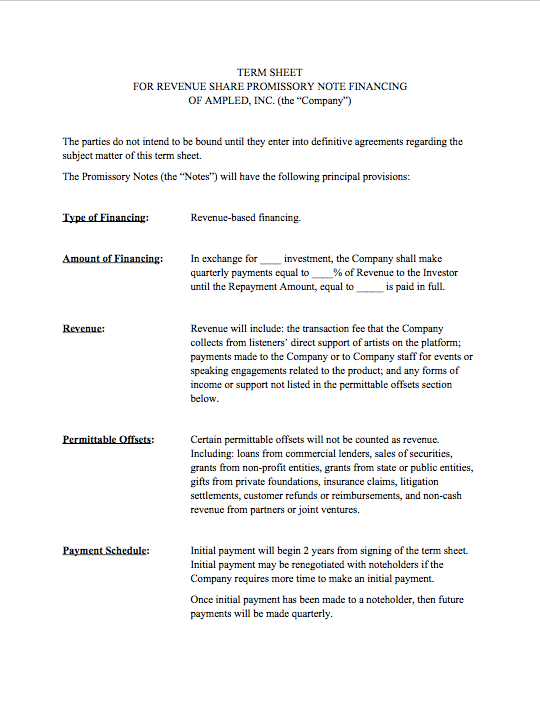

This year, Ampled worked with the CUNY Community & Economic Development Clinic to develop simple revenue share investment term sheets, which allow organizations to receive funding while retaining ownership and control. We are openly sharing them here for anyone to adapt, use, and improve.

Our goal with Ampled is to create a platform that is 100 percent owned by its users—our artists, workers, and community—-not investors. It’s why we decided to become a cooperative instead of a standard Delaware C Corporation. However, cooperative or not, building any tech-enabled platform like Ampled requires real resources. It requires people, time, sweat—and money. In order to retain ownership for our community, we looked for investment vehicles that would allow us to deliver returns to investors—without giving them any ownership or control (above that of a normal member of Ampled).

Unsurprisingly, the idea of funding a startup while not giving investors equity or control is something that excludes us from many prospective investors. Because we don’t plan on having a priced round of fundraising, we are also excluded from most traditional startup investment vehicles like SAFEs and convertible notes. We are also largely disqualified from participating in the most common startup accelerator programs. More traditional funding sources like bank loans are off the table as well; a risky pre-revenue startup is not an attractive candidate for any kinds of commercial loans—even if we could personally guarantee them. Because cooperatives are for-profit enterprises, we are also largely disqualified from many sources of funding used by non-profit organizations.

What other options are there?

Thanks to a tip from Greg Brodsky at Start.coop, we started looking seriously at revenue-based financing, a way to raise money that involves an exchange of investment for a small percentage of top-line revenue, paid back to a capped return (typically between a 1.35x and 4x multiple).

Over the last several weeks, CUNY Law School has helped Ampled draft some custom revenue based financing investment terms that helped meet our needs. Below is an edited transcript of a conversation I had with Rafael Varela, an attorney from CUNY Community Economic Development Clinic about the development of these terms.

Revenue Based Financing Term Sheet for Ampled Download

Austin Robey: Thank you so much for working with Ampled on these terms and helping put them together! Your work has been very helpful. Could you talk about the CED and how it works with CUNY and the type of work that you typically take on?

Rafael Varela: CUNY Law is one of the most well known public interest law schools in the country and the community and economic development clinic was started around a decade ago ago by my director, Carmen, and the idea was to provide legal education, transactional assistance, and community education around the idea of economic democracy—that can look like different things whether its affordable housing, businesses in an llc format, or worker cooperative models. The idea being we would normally work with clients who are trying to build up an ecosystem for economic democracy, or trying something completely new and different.

We typically work with organizations and cooperatives that aren’t necessarily “brick and mortar” but may either be collectives of domestic workers, or are trying to change supply chains in hospitals—so being approached by an organization that is trying to change a big part of the tech and entertainment industry is a bit new, but I thought it was extremely exciting—and I thought you guys were trying to do something that is long overdue.

There’s been a number of pieces on how musicians and artists of all kinds, have their work undervalued or stolen or not attributed. And with my work specifically around us supporting wealth growth and education for queer people of color, I saw that what you all are doing is something that would directly benefit that community.

We often look for individuals who are living the values and are committed to the idea of economic democracy and cooperatives, who maybe don’t have the language or full understanding but want to build something. What we try to avoid is profit motive as the overarching purpose of an organization. We understand that profit is necessary for these entities to survive, but valuing people above their work is how we decided to work with you and how we choose our clients.

Thank you! For us working together, you mentioned how this is a bit different from your other work because we are a tech-enabled company and a platform. Let’s talk about the problem we were trying to solve together and how that is different from your other work. Our organization is looking to raise investment, because building a platform is resource and capital intensive work, and we’re trying to raise money in a way that doesn’t give control or ownership to investors, yet is still an attractive investment and can deliver meaningful returns. So that’s where we started. I’m wondering what your thoughts are on this example of revenue-based financing, how we’ve approached it, and how you’ve seen it applied in different ways.

As I mentioned before, we typically work with organizations that are typically trying to build storefronts, trying to raise capital for appliances or worker training, and other things like that. Typically investors will want some kind of share or power. What you all have propositioned, I think is a stark shift from that. And so, what we have here is this idea that you’re going to offer these investors a return for their money, but you’re not going to give them control.

One of the differences that I’ve seen with this term sheet and other revenue-based financing term sheets is the removal of preference shares or redeemable preference shares. Is that something that you’ve seen in the past? I’ve noticed that revenue-based financing is typically not structured as debt but as equity. So in many revenue-based financing terms, people are buying non-voting shares with the idea that only the company can buy them back. For the sake of clear communications, enabling us to say “This platform is owned by its users, not investors,” we decided to not structure these terms with redeemable preference shares.

I think you’ve hit it on the head. It’s typical for someone to want equity or buy-in. Often there are people a preference shares the option of getting a predetermined amount of money for your investment. You’re not offering that here, and I think that it’s really encouraging to see that you are still getting a lot of interest and people who want to support the project even without these lures that typically attract investors. I think that’s one of the differences from we’ve done in the past. Providing stakeholders shares or stakeholder interests, these are the ways in which we typically have to bring in people with capital to invest in a project.

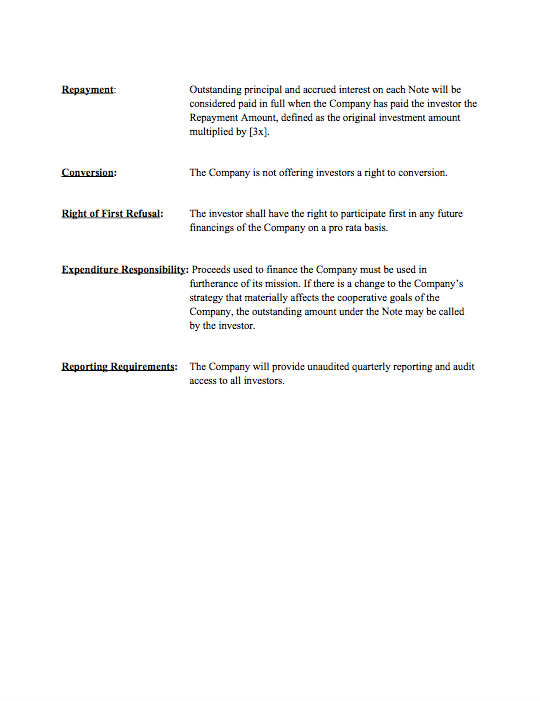

I think this is a very pro-democratic term sheet. The Expenditure Responsibility section is probably my favorite section. You’re not only telling your investors that all of the capital that they’re providing is to further the mission of the cooperative nature of Ampled, but you’re also holding yourselves accountable by saying that if that if you lose your path and violate your mission, the investment can be called back.

Let’s see if we can go through some of this and break it down a bit. The goal we had was making something as simple as possible. In the “Amount Of Financing” section it reads as a pretty simple exchange. Which basically says, in exchange for investment, we pay back a small portion of our topline revenue back to investors. Then, we defined what was revenue and what wasn’t revenue.

The idea of defining what’s not revenue, it’s a defense mechanism. It’s a way to protect the organization and to tell investors what is not part of a revenue share.

The way that we broke it down, it was that revenue is money that we’re getting from services. Anything that was a Permittable Offset is basically money that’s meant to be either an investment or a gift in some way. And that’s how we tried to break it down.

That keeps it simple.

We ended up co-designing this with some of the initial investors.

Which is actually… I have a quick question for you. Is that, in your experiences, is that a typical process that the investors are co-designing the term sheet with you?

Well, this is the first time I’ve ever raised money, haha. So, I have no idea. We are lucky to have such sympathetic investors that are patient and care about our mission.

In the payout schedule, I think a concern for investors was actually, that they don’t want to be paid back too soon. They feel that money could be much better spent growing the platform, rather than paying them back. So, what we like collectively decided was to have repayment start two years after people sign this revenue based financing term sheet.

It’s pretty straight forward.

On the “Repayments” section, we are basically defining capped returns. An important tenant of these terms is that financial upside isn’t infinite. Basically, we’ve capped the returns depending on what stage the investor came in, which would be between three and four times their principal. And then, we’re saying that when they are paid back that repayment amount, then the obligation to the investor is fulfilled.

On the “Conversion” section. In other revenue based financing terms that I’ve seen, there’s typically a conversion to equity if certain repayment goals have not been met, in accordance with projections. And I guess this was unique for us because as a cooperative, equity conversion isn’t really applicable or something that we would want. So you mentioned that it was just a good thing to have in there and spell that out.

I mean, it’s a good thing to show your investors right off the bat, right? There’s no conversion at all. Just makes it clear. And it also protects you all in the sense that like you’re going to be having folks who understand that their investment is, the power of their investment is limited and that they won’t have this possible stake in the future. So, it’ll make sure that you’re getting investors that believe in your mission and understand the restrictions that it places on them.

The next section is kind of like a carrot to investors. The Right Of First Refusal is basically saying in effect that, if an investor wanted to invest in future funding opportunities with Ampled, they can be first in line.

What you’re basically saying is since you’ve already come in first. We spoke about this a little earlier, but if you’re not entirely sure what future funding rounds would look like, this would allow an investor to come back and get first dibs in the next financing opportunity.

Moving to the “Reporting Requirements,” we basically wanted to make sure that we were transparent. That we would give people audit access. But at the same time, that we don’t want to be burdened by monthly reporting or reporting requirements to a broad base of investors that may not even care about receiving detailed reports every month.

You’re giving your investors a raw look at the data and ideally that’s going to fulfill their need for information.

The other question: we want to make this publicly available in hopes that people and can take from these terms, or improve upon them. What would we say to people that want to use something like this for their own fundraising?

Well, we’ve tailored this specifically to Ampled’s context at the moment, right? Every organization and its goals are going to be different. You know, I mentioned earlier, we have created the appropriate organizations that allow for small versions of stakeholder equity, right? So that’s something that’s considered like these term sheets, in many ways, sort of choose your own infrastructure kind of experience. And so if you find yourself having investors that need a little something. That they need some sort of stake, you can tweak this. You have to make sure that it’s in line with the applicable state regulations. And you know, things change when you’re talking about amounts of money and what the nature of the work is itself. But yeah, I mean, I think what you all are doing here, this is sort of, for me, one of my first experiences with a term sheet that is very cooperative friendly.

So I’m really excited to see how folks mold it, change it and when we come up with the promissory note. It’s going to reflect the, sort of, democratic principles that you’ve created here. And I hope that we can also make that an open source resource for folks. But, you all have tailored something really exciting here. And, I think that as folks… It’s always a great idea to talk you all are doing. If you need to find an attorney, you know, because like we talked earlier with caps, with conversion to equity, there’s a lot of pitfalls and a lot of risks when it comes to what an investor might want. And if you’re not clear with the language, then they can ask for it.

Interested in following along with updates on Ampled? Go to www.ampled.com and sign up for our newsletter.